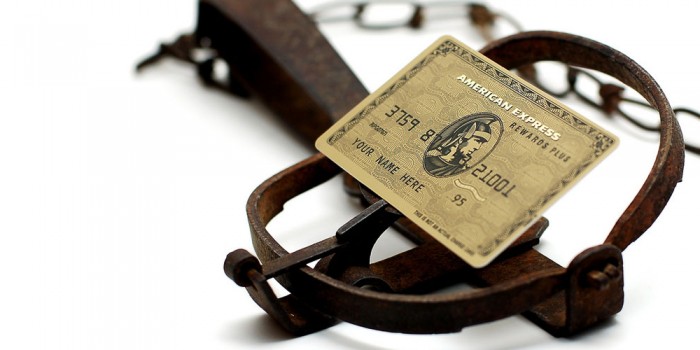

$9.99 It’s almost akin to a retail disease. Walk into any shop and the prices frequently end in the same way: $X.99 or $X.95. This used to have some unfortunate consequences. I’m old enough to remember the days when you might well end up carrying around a couple of kilos of small change in your pockets. Then, when the burden got to great, or you got irritated with sounding as though you were wearing a manacle as it ‘chinked’ with each step you took, you would act. The social consequence of spending a disproportionately long time at the checkout would be outweighed by the desire to move freely and you would pay for the next item using as many coins as you could. The upside of this was that it was very good for your mental maths. You would work out how the small change you had could be deployed […]

Recent Comments